Reflections on an Anti-Market Fundamentalist

To hear the former Prime Minister tell the story how he saved Australia from the Global Financial Crisis so lacks plausibility that I thought I would review a couple of matters.

Firstly, no one who thinks about what held the economy up during 2009 leaves out the role of China. It was China’s own massive stimulus that resurrected the mining industry in Australia and held the economy up.

This was aside from the fact that our banks held a relatively low proportion of their assets in the toxic forms that had been issued by the American financial system. Once the government guaranteed bank deposits concerns about the viability of the financial system almost immediately disappeared as did most of the concerns about the Australian economy.

There was therefore little need for a stimulus program and no need whatsoever for the massive expenditure that was undertaken. That the uselessness of so much of this spending is coming to light after government efforts in every direction to suppress just how bizarrely wasteful it has been, only suggests there is probably much more and much worse we do not know about.

But the cost itself has been fantastic. The only reason the following numbers I presented to the Senate have not been generally recognised is, I think, because no one can credit a government can be this incompetent.

But just maybe they can be exactly that incompetent. And the numbers are these. There was $43 billion spent on the stimulus, that is, $43,000 million. If the stimulus added no more than 43,000 jobs to the total level of employment, the cost of the stimulus came at $1,000,000 per job.

But to give the Government the benefit of the doubt, suppose the stimulus added 100,000 jobs. Then the cost of each additional job saved was $430,000. What a stunning expense for so paltry a return.

And beyond that there are all of the lost private sector activity that is certain to have occurred as Governments used up our domestic savings for projects of its own. This is productive activity that will never return, while in the meantime the debts that have been incurred will be there for years to come.

National Accounts

Then we are supposed to have avoided recession because of the actions taken by the Government which is demonstrated because we did not have two consecutive quarters where the recorded level of GDP actually fell.

The problem with this way of thinking about our economic circumstances is this. If the government spends money, so far as the National Accounts are concerned, the spending counts as real activity no matter what it is on.

Normally it doesn’t much matter since one year’s government spending is near enough the same as the year before so no major distortions. But during the GFC, when there were massive increases in public spending on useless insulation materials and on wildly overpriced school facilities, these went in just as they were. Spend a billion record a billion dollars worth of activity. And the more wildly overpriced some school canteen was, the higher the level of real growth recorded in the National Accounts.

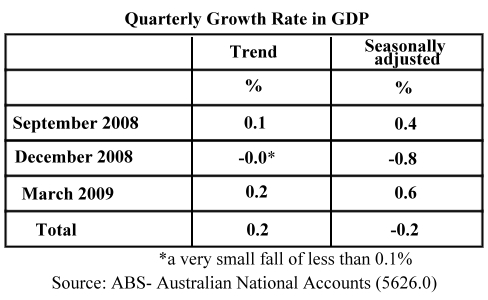

Let me therefore point out what did happen to the growth rate in Australia’s GDP, using both the trend and seasonally adjusted figures for the relevant quarters.

With a stimulus expenditure of $43 billion – around four percent of one year’s GDP – we avoided having a “technical” definition of recession by 0.2 percentage points. With a reduction of 0.2 percentage points in the trend figures for September 2008 Australia would have had a technical recession to go along with the actual recession we really did indeed have.

The Quality of Economic Management

Rudd’s attitude to “market fundamentalism” is a wonderful reminder of why if an economy is going to be run well, a government’s best friend is its business community. It is business that for all practical purposes constitutes the market.

Business produces the goods and services we buy, pays most of the productive wages earned across the economy and funds virtually all tax receipts. The destructive forces unleashed by Rudd’s belief that he could show us how it could be done without business and without relying on the market has only proved, once again, that there is no option but reliance on business and on the market.

Why this is so strongly resisted by so many at every turn I have no idea. Irrationality seems part of the human condition. It’s just good that we have a political system that can at least potentially knock on the head political leaders and their advisors who bungle the management of our affairs.

Sign In

Sign In 0 Items (

0 Items ( Search

Search